Using iBGT on BeraBorrow, Timeswap, and Kodiak | Infrared testnet guide pt. 2

Over the past month our Berachain testnet deployment of iBGT has gained significant traction — making Infrared the largest BGT delegate.

As part of our testnet efforts, we’ve worked with partners to integrate iBGT into their protocols, which we’ll walk you through in this guide. The partners featured in this guide include: BeraBorrow, TimeSwap, and Kodiak.

Note: This guide does not involve any real money and the use of the word “rewards” is not a promise of mainnet rewards.

Getting started

Before using the dapps in this guide, you’ll need to get your hands on some iBGT. This can be done in one of two ways:

- If you want iBGT quickly, you can swap other testnet assets for iBGT using the BEX.

- If you’re willing to wait, you can earn iBGT by providing liquidity to Infrared’s Proof of Liquidity vaults. Find the written guide. We also have a video guide below:

Using BeraBorrow

BeraBorrow, one of the first dapps to integrate iBGT, is a decentralized borrowing protocol that allows users to deposit iBGT as collateral. By depositing iBGT, users can borrow NECT, a USD-pegged stablecoin that can be used throughout the Berachain ecosystem.

Note: The BeraBorrow testnet will be launching to the public soon. Follow their socials for the official announcement.

If you have access, or are reading this after the public testnet launch, using BeraBorrow is simple. Start by heading to their borrow page and selecting iBGT as your collateral. By doing so, you’ll be depositing iBGT into the BeraBorrow smart contracts to create a leveraged position.

After entering the amount of iBGT you’d like to use as collateral and specifying the amount of NECT you’d like to borrow, the interface will display your collateral ratio.

For example, the image above shows a collateral ratio that’s safely above the 120% liquidation threshold. Liquidation happens when the value of your iBGT decreases and your collateral ratio drops below this threshold.

Once you’re satisfied with your position, click “Approve” and then “Borrow,” and you’re done! You’ll now own some NECT tokens that you can use on other dapps or deposit into the BeraBorrow Stability Pool.

Learn more about BeraBorrow.

Using Timeswap

Next, we have Timeswap, a permissionless money market that recently launched on Berachain’s testnet. Timeswap allows users to permissionlessly borrow or lend tokens, enabling lenders to earn yield and borrowers to access non-liquidatable leverage.

To get started, head to their Berachain markets page. You’ll see two markets: iBGT/HONEY and HONEY/iBGT.

For this example, we’ll be lending iBGT to the iBGT/HONEY market, listed first in the screenshot. To lend iBGT, click “Lend” on that market. By lending my iBGT, we’re allowing other users to borrow iBGT against their HONEY as collateral.

Next, input the amount of iBGT you want to lend. The UI will display how long your iBGT will be locked (e.g. until October 18, 2024) and the “Fixed APR” you’ll earn over that period. Once you approve iBGT and deposit it into the market, you can check your position for more details.

Note: You can also borrow on Timeswap, following a similar process to BeraBorrow. Feel free to explore their borrowing feature yourself!

Learn more about Timeswap here.

Using Kodiak

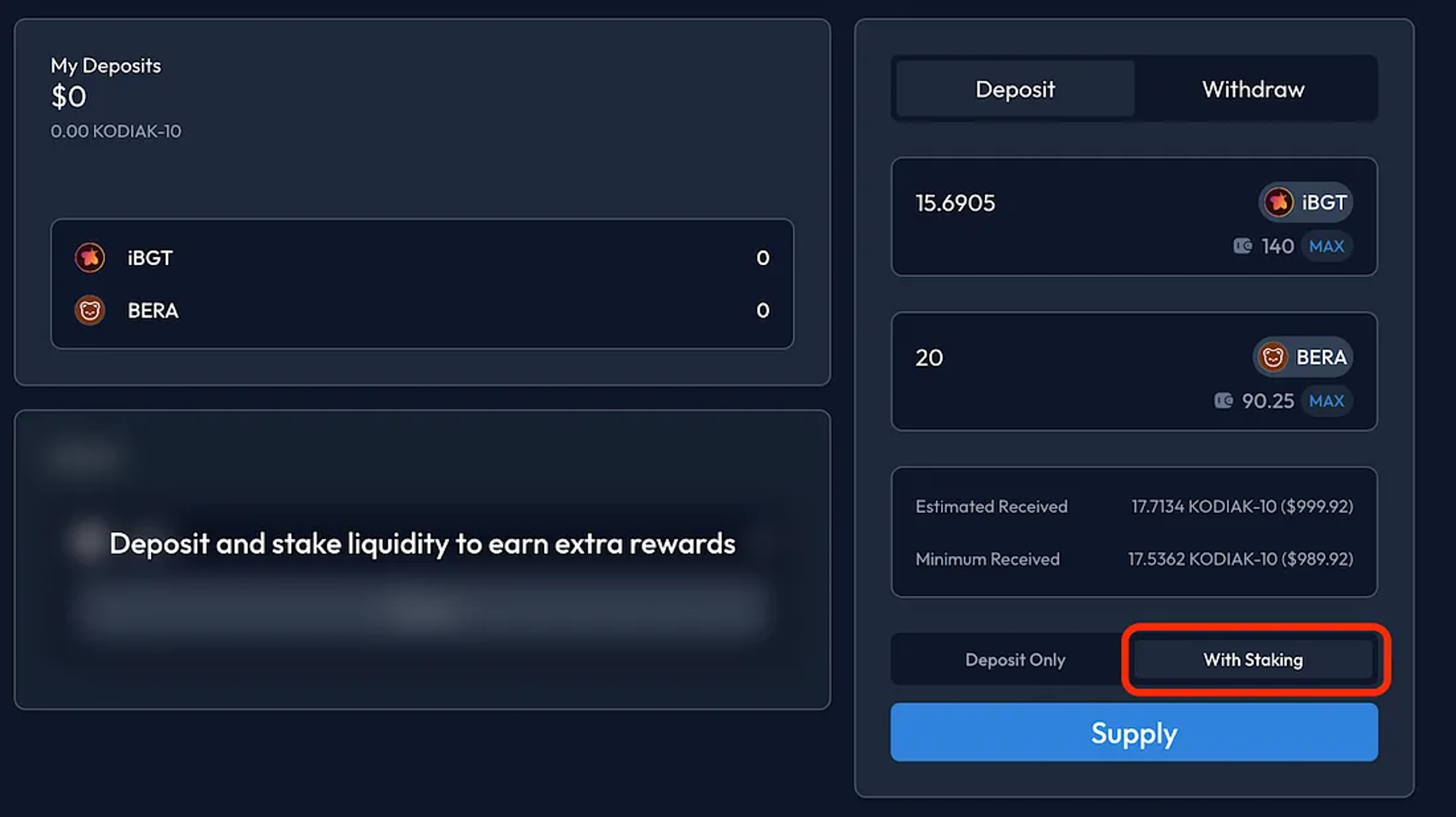

Last but not least in our guide is Kodiak, a vertically integrated liquidity hub on Berachain. In this section, we’ll be depositing both iBGT and BERA into one of Kodiak’s “Islands.”. Islands are automated liquidity management vaults that simplify the management of concentrated liquidity positions on their underlying DEX.

To start, navigate to the iBGT-BERA Island. You’ll be prompted to deposit iBGT and BERA in an equal ratio based on their USD value.

After entering the amount of tokens to deposit, select “With Staking” before clicking “Supply” and follow the prompts. This ensures you earn all the testnet rewards offered by Kodiak.

During the deposit process, you’ll be asked to choose a staking duration, with 30 days being the maximum. Selecting 30 days gives you the largest rewards multiplier of up to 3x. That’s what we’re choosing.

Once complete, you can track your position and claim rewards directly on the iBGT-BERA Island page as shown below.

Learn more about Kodiak.

What’s next?

The projects mentioned throughout this guide are not an exhaustive list of the projects integrating iBGT, so we urge you to explore the other opportunities available. To keep up with future partnerships, follow Infrared at the links below.

On this page